Speed Reading Training, part V

Tuesday, August 15, 2006

Speed Reading Training (Index).

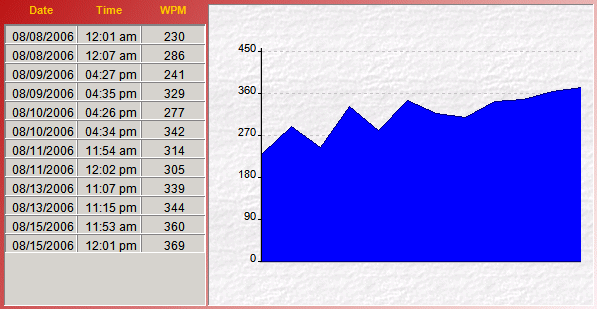

By the looks of this lesson's progress chart (session 6), my reading speed has increased from 230 wpm to 360 wpm (this is my before training session score).

Not too shabby, but reading regular books still feels the same and I haven't timed myself while reading leisurely to see if I have actually improved.

I have noticed, though, that I can turn my freaky speed reading ability at will, but it doesn't feel natural. Although I can still retain what I read, I don't think I could speed-read a whole book just yet--it seems to be too tiring and requires too much concentration.

I have come to see this speed-reading techniques like walking and running: I could actually run through the park on Sunday afternoons, but what would be the point of that when a slow stroll is much more enjoyable. In other words, with great speed-reading powers, comes great reading responsibilities.

Progress chart:

By the way, I'm currently reading "A Random Walk Down Wall Street," by Burton G. Malkiel. (Progressing through MBA studies and after the first Financial Management course, I seem to have taken an interest in Finance, hence I enrolled in the Fall's version of

Investment Management and thought this book may be good a read.)

As usual, I have my own points of view on this particular book and I'm not afraid to express them: on the one hand, it is a good read because it has good explanations of technical subjects; on the other hand, this book may not be for everyone (leaving aside the fact that it is targeted to a U.S. audience): although the author has made every effort to write simple and coherent sentences about a subject that requires in-depth knowledge of finance theory, some explanations seem light because of the fact he has used simple and coherent sentences, i.e., he can't explain every technicality as to appeal to a broader audience.

Don't take me wrong, most of the themes are not hard, but if you come from a non-finance background and you are able to understand CAPM or bond yields just from one read of this book, my hat is off to you.

Note, however, that Malkiel seems to know what he is talking about and the book's main theme is the one of diversification.

I think everyone can understand that well diversified investment portafolios reduce overall risk. In such cases, who cares if you can or can't calculate the standard deviation of your returns (which is, according to Modern Portfolio Theory, the overall risk).

In addition, he wrote the book 30 years ago but he keeps getting money from the same publisher to update it as time goes by. Though, the interest and popularity of this book can be attributed to various reasons, of which I speculate: one, there are quite a few MBA grads around that like to read about the market and use it a refresher; two, the general public is more informed than they were before and know a bit more of finance theory to fully understand this book; or three, most leisure readers buy the book, read the first few chapters and stop reading or skipping the more technical pages and not tell anyone they didn't read it whole. (I don't know, but I have a feeling it's a combination of the three.)

Anyway, I have tried to speed-read through a couple of pages, but, like I said, it is very taxing and I end up slowing down. Perhaps with more practice I can speed-read a whole chapter.

Comments: